In today’s dynamic business landscape, where uncertainty can often feel like the only constant, strengthening risk management is not just a protective measure—it’s a strategic imperative for long-term growth. Organizations face a myriad of challenges, from economic fluctuations and technological disruptions to shifting regulatory environments and changing consumer behaviors.

These factors can create a perfect storm of risk that, if not navigated effectively, may erode hard-earned gains and stifle innovation. To thrive in this unpredictable environment, companies must adopt a holistic approach to risk management, one that goes beyond mere compliance and incorporates proactive strategies.

This means cultivating a culture of resilience and agility, leveraging data-driven insights, and fostering cross-departmental collaboration. Ultimately, the goal is not just to survive but to seize opportunities amidst adversity, transforming potential threats into catalysts for growth.

As we explore the multifaceted strategies to enhance risk management practices, it’s crucial to understand that a robust framework today lays the groundwork for success tomorrow.

Understanding the Importance of Risk Management for Longevity

Understanding the importance of risk management for longevity is essential for any organization intent on securing its future. At its core, effective risk management is not just about avoiding pitfalls; it’s about anticipating potential challenges and seizing opportunities amidst uncertainty.

Consider this: a company that meticulously audits its financial exposures or evaluates potential market shifts is not merely following a checklist; it is weaving a safety net that enhances confidence, fosters innovation, and ultimately positions itself for sustainable growth. This principle is especially evident in sectors such as London Non-Executive Recruitment, where anticipating regulatory changes, talent availability, and market dynamics is crucial to maintaining credibility and long-term stability. Conversely, neglecting to incorporate robust risk assessment strategies can lead to a false sense of security, paving the way for unforeseen setbacks that could jeopardize long-term success.

In this dynamic landscape, a proactive and comprehensive approach to risk management can serve as a beacon, guiding organizations through storms while reinforcing their foundation for enduring achievement.

Identifying Key Risks: The First Step to Effective Management

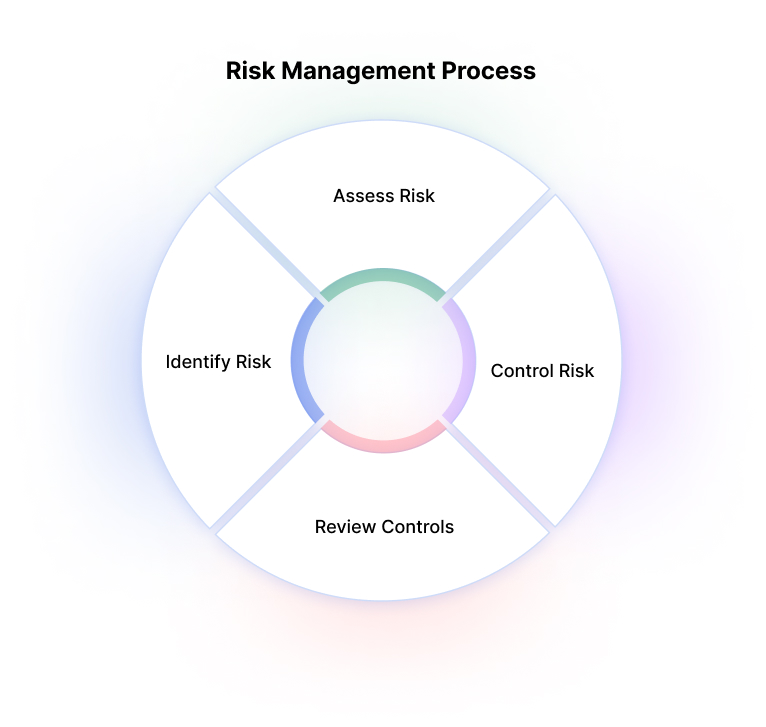

Identifying key risks is not merely a procedural formality; it is the bedrock of effective risk management. Organizations must delve deep into their operational landscapes, scrutinizing both internal processes and external pressures that could jeopardize their objectives.

This involves a meticulous assessment of various factors—financial vulnerabilities, technological dependencies, regulatory shifts, and even market trends that ebb and flow unpredictably. Think of it as constructing a mosaic: each piece, whether it be a potential cyber threat or a disruption in supply chains, contributes to a larger picture of risk exposure.

By prioritizing risk identification, leaders can craft tailored strategies that not only mitigate threats but also leverage growth opportunities. Thus, the journey toward resilience begins with a keen, unflinching gaze at what lurks in the shadows, ready to challenge the organization’s aspirations.

Building a Risk Assessment Framework: Tools and Techniques

Building a robust risk assessment framework is vital for navigating the complexities of today’s dynamic business landscape. At the heart of this framework are essential tools and techniques that help organizations identify, analyze, and mitigate risks effectively.

Begin with risk matrices, which simplify the evaluation of potential threats by categorizing them based on likelihood and impact, offering a clear visual representation for decision-makers. Complement this with qualitative techniques like SWOT analysis — a powerful tool that aids in understanding internal strengths and weaknesses alongside external opportunities and threats. Incorporating quantitative methods, such as Monte Carlo simulations, can provide deeper insights into potential outcomes by modeling various scenarios.

Moreover, fostering a culture of collaboration across departments ensures a diverse pool of perspectives that drives more comprehensive risk assessments. By integrating these varied methodologies, businesses can enhance their ability to anticipate challenges, adapt swiftly, and ultimately fortify their strategies for sustainable growth.

Conclusion

In conclusion, strengthening risk management is essential for any organization aiming for long-term growth and sustainability. By implementing comprehensive risk assessment frameworks, fostering a culture of transparency, and prioritizing continuous training for employees, businesses can better mitigate potential threats and seize emerging opportunities.

Moreover, leveraging specialized recruitment services, such as London Non-Executive Recruitment, can provide access to experienced professionals who can guide organizations in developing robust risk management strategies. Ultimately, a proactive and informed approach to risk management not only safeguards assets but also positions companies to thrive in an ever-evolving market landscape.